Pharmaceutical Intermediates Industry Overview

Pharmaceutical intermediates

The so-called pharmaceutical intermediates are actually chemical raw materials or chemical products that need to be used in the synthesis process of drugs. These chemical products can be produced in ordinary chemical plants without obtaining a drug production licence, and can be used in the synthesis and production of drugs as long as the technical indicators meet certain level requirements. Although the synthesis of pharmaceuticals also falls under the chemical category, the requirements are more stringent than those for general chemical products. Manufacturers of finished pharmaceuticals and APIs need to accept GMP certification, while manufacturers of intermediates do not, because intermediates are still only the synthesis and production of chemical raw materials, which are the most basic and bottom products in the drug production chain, and cannot be called drugs yet, so they do not need GMP certification, which also lowers the entry threshold for intermediates manufacturers.

Pharmaceutical intermediates industry

Chemical companies that produce and process organic/inorganic intermediates or APIs for pharmaceutical companies for the manufacture of finished pharmaceutical products by chemical or biological synthesis according to strict quality standards. Here the pharmaceutical intermediates are divided into two sub-industries CMO and CRO.

CMO

Contract Manufacturing Organization refers to a contract manufacturing organization, which means that the pharmaceutical company outsources the manufacturing process to a partner. The business chain of the pharmaceutical CMO industry generally starts with specialised pharmaceutical raw materials. Companies in the industry are required to source basic chemical raw materials and process them into specialised pharmaceutical ingredients, which are then processed into API starting materials, cGMP intermediates, APIs and formulations. At present, major multinational pharmaceutical companies tend to establish long-term strategic partnerships with a small number of core suppliers, and the survival of companies in this industry is largely evident through their partners.

CRO

Contract (Clinical) Research Organization refers to a contract research organisation, where pharmaceutical companies outsource the research component to a partner. At present, the industry is mainly based on custom manufacturing, custom R&D and pharmaceutical contract research and sales. Regardless of the method, whether the pharmaceutical intermediate product is an innovative product or not, the core competitiveness of the company is still judged by the R&D technology as the first element, which is reflected in the company's downstream customers or partners.

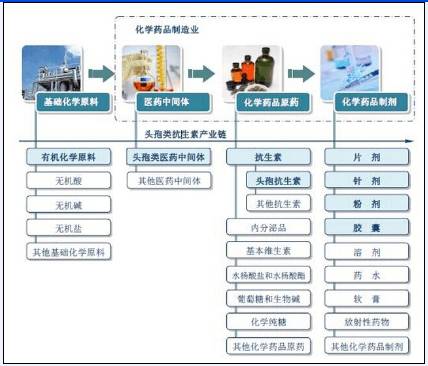

Pharmaceutical product market value chain

Picture

(Image from Qilu Securities)

Industry chain of pharmaceutical intermediates industry

Picture

(Picture from China Industry Information Network)

Pharmaceutical intermediates classification

Pharmaceutical intermediates can be divided into big categories according to application fields, such as intermediates for antibiotics, intermediates for antipyretic and analgesic drugs, intermediates for cardiovascular system drugs and pharmaceutical intermediates for anti-cancer. There are many kinds of specific pharmaceutical intermediates, such as imidazole, furan, phenolic intermediates, aromatic intermediates, pyrrole, pyridine, biochemical reagents, sulfur-containing, nitrogen-containing, halogen compounds, heterocyclic compounds, starch, mannitol, microcrystalline cellulose, lactose, dextrin, ethylene glycol, sugar powder, inorganic salts, ethanol intermediates, stearate, amino acids, ethanolamine, potassium salts, sodium salts and other intermediates, etc.

Overview of the development of the pharmaceutical intermediates industry in China

According to IMS Health Incorporated, from 2010 to 2013, the global pharmaceutical market maintained a steady growth trend, from US$793.6 billion in 2010 to US$899.3 billion in 2013, with the pharmaceutical market showing faster growth from 2014, mainly due to the US market. With a CAGR of 6.14% from 2010-2015, the international pharmaceutical market is expected to enter a slow growth cycle from 2015-2019. However, as medicines are in rigid demand, net growth is expected to be very strong in the future, with the world market for medicines approaching US$1.22 trillion by 2019.

Image

(Image from IMS Health Incorporated)

At present, with the industrial restructuring of large multinational pharmaceutical companies, the transfer of multinational production and the further refinement of the international division of labour, China has become an important intermediate production base in the global division of labour in the pharmaceutical industry. China's pharmaceutical intermediates industry has formed a relatively complete system from research and development to production and sales. From the development of pharmaceutical intermediates in the world, China's overall process technology level is still relatively low, a large number of advanced pharmaceutical intermediates and patent new drugs supporting intermediates production enterprises are relatively small, is in the development stage of product structure optimization and upgrading.

Output value of chemical pharmaceutical intermediates industry in China from 2011 to 2015

Picture

(Picture from China Business Industry Research Institute)

During 2011-2015, China's chemical pharmaceutical intermediates industry output grew year by year, in 2013, China's chemical pharmaceutical intermediates output was 568,300 tons, exported 65,700 tons, by 2015 China's chemical pharmaceutical intermediates output was about 676,400 tons.

2011-2015 China chemical pharmaceutical intermediates industry production statistics

Picture

(Picture from China Merchant Industry Research Institute)

The supply of pharmaceutical intermediates in China is more prominent than the demand, and the dependence on export is gradually increasing. However, China's exports are mainly concentrated in bulk products such as vitamin C, penicillin, acetaminophen, citric acid and its salts and esters, etc. These products are characterized by huge product output, more production enterprises, fierce market competition, low product price and added value, and their mass production has caused the situation of supply exceeding demand in the domestic pharmaceutical intermediates market. Products with high technology content still mainly rely on import.

For the protection of amino acid pharmaceutical intermediates, most of the domestic production enterprises have a single product variety and unstable quality, mainly for foreign biopharmaceutical companies to customize the production of products. Only some enterprises with strong research and development strength, advanced production facilities and experience in large-scale production can obtain high profits in the competition.

Analysis of China's pharmaceutical intermediates industry

1, pharmaceutical intermediates industry custom production process

First, to participate in the customer's research and development of new drugs stage, which requires the company's R & D centre has a strong innovation ability.

Secondly, to the customer's pilot product amplification, to meet the process route of large-scale production, which requires the company's engineering amplification ability of the product and the ability of continuous process improvement of the customized product technology at a later stage, so as to meet the needs of product scale production, continuously reduce the production cost and enhance the competitiveness of the product.

Thirdly, it is to digest and improve the process of the products in the stage of mass production of customers, so as to meet the quality standards of foreign companies.

2. Characteristics of China's pharmaceutical intermediates industry

The production of pharmaceuticals requires a large number of special chemicals, most of which were originally produced by the pharmaceutical industry itself, but with the deepening of social division of labour and the progress of production technology, the pharmaceutical industry transferred some pharmaceutical intermediates to chemical enterprises for production. Pharmaceutical intermediates are fine chemical products, and the production of pharmaceutical intermediates has become a major industry in the international chemical industry. At present, China's pharmaceutical industry needs about 2,000 kinds of chemical raw materials and intermediates every year, with a demand of more than 2.5 million tons. As the export of pharmaceutical intermediates unlike the export of drugs will be subject to various restrictions in the importing countries, as well as the world production of pharmaceutical intermediates to developing countries, the current Chinese pharmaceutical production needs of chemical raw materials and intermediates can basically match, only a small part of the need to import. And because of China's abundant resources, raw material prices are low, there are many pharmaceutical intermediates also achieved a large number of exports.

At present, China needs chemical supporting raw materials and intermediates of more than 2500 kinds, the annual demand reached 11.35 million tons. After more than 30 years of development, China's pharmaceutical production needs of chemical raw materials and intermediates have basically been able to match. The production of intermediates in China is mainly in the antibacterial and antipyretic drugs.

Throughout the industry, China's pharmaceutical intermediates industry has six characteristics: First, most of the enterprises are private enterprises, flexible operation, the investment scale is not large, basically between millions to one or two thousand million yuan; Second, the geographical distribution of enterprises is relatively concentrated, mainly in Taizhou, Zhejiang Province and Jintan, Jiangsu Province as the centre; Third, with the country's increasing attention to environmental protection, the pressure on enterprises to build environmental protection treatment facilities is increasing Fourthly, the product renewal speed is fast, and the profit margin will drop drastically after 3 to 5 years in the market, forcing enterprises to develop new products or improve the process continuously in order to obtain higher profits; Fifthly, since the production profit of pharmaceutical intermediates is higher than that of general chemical products, and the production process is basically the same, more and more small chemical enterprises join the ranks of producing pharmaceutical intermediates, resulting in increasingly fierce competition in the industry Sixth, compared with API, the profit margin of producing intermediates is low, and the production process of API and pharmaceutical intermediates is similar, so some enterprises not only produce intermediates, but also use their own advantages to start producing API. Experts pointed out that the production of pharmaceutical intermediates to the direction of API development is an inevitable trend. However, because of the single use of API, by the pharmaceutical companies have a great impact, the domestic enterprises often develop products but no users of the phenomenon. Therefore, manufacturers should establish a long-term stable supply relationship with pharmaceutical companies, in order to ensure smooth product sales.

3, industry entry barriers

①Customer barriers

The pharmaceutical industry is monopolised by a few multinational pharmaceutical companies. The pharmaceutical oligarchs are very careful in their choice of outsourcing service providers and generally have a long inspection period for new suppliers. Pharmaceutical CMO companies need to meet the communication patterns of different customers, and need to undergo a long period of continuous assessment before they can gain the trust of downstream customers, and then become their core suppliers.

②Technical barriers

The ability to provide high technology value-added services is the cornerstone of a pharmaceutical outsourcing service company. Pharmaceutical CMO companies need to break through technical bottlenecks or blockages in their original routes and provide pharmaceutical process optimisation routes to effectively reduce drug production costs. Without long-term, high-cost investment in research and development and technology reserves, it is difficult for companies outside the industry to truly enter the industry.

③Talent barriers

It is difficult for CMO companies to build a competitive R&D and production team in a short period of time to establish a cGMP-compliant business model.

④Quality regulatory barriers

The FDA and other drug regulatory agencies have become increasingly stringent in their quality control requirements, and products that do not pass the audit cannot enter the markets of importing countries.

⑤ Environmental regulatory barriers

Pharmaceutical companies with outdated processes will bear high pollution control costs and regulatory pressure, and traditional pharmaceutical companies that mainly produce high pollution, high energy consumption and low value-added products (e.g. penicillin, vitamins, etc.) will face accelerated elimination. Adhering to process innovation and developing green pharmaceutical technology has become the future development direction of pharmaceutical CMO industry.

4. Domestic pharmaceutical intermediates listed enterprises

From the position of the industry chain, the 6 listed companies of fine chemicals producing pharmaceutical intermediates are all at the low end of the industry chain. Whether to professional outsourcing service provider or to API and formulation extension, technical strength is the constant core driving force.

In terms of technological strength, companies with technology at the leading international level, strong reserve strength and high investment in R&D are favoured.

Group I: Lianhua Technology and Arbonne Chemical. Lianhua Technology has eight core technologies such as ammonia oxidation and fluorination as its technological core, of which hydrogen oxidation is at the international leading level. Abenomics is an international leader in chiral drugs, especially in its chemical splitting and racemization technologies, and has the highest R&D investment, accounting for 6.4% of revenue.

Group II: Wanchang Technology and Yongtai Technology. Wanchang Technology's waste gas hydrocyanic acid method is the lowest cost and most advanced process for the production of prototrizoic acid esters. Yongtai Technology, on the other hand, is known for its fluorine fine chemicals.

Group III: Tianma Fine Chemical and Bikang (formerly known as Jiuzhang).

Comparison of technical strength of listed companies

Picture

Comparison of customers and marketing models of listed pharmaceutical intermediates companies

Picture

Comparison of downstream demand and patent life cycle of listed companies' products

Pictures

Analysis of product competitiveness of listed companies

Pictures

The road to upgrading of fine chemical intermediates

Pictures

(Pictures and materials from Qilu Securities)

Development prospects of China's pharmaceutical intermediates industry

As an important industry in the field of fine chemical industry, pharmaceutical production has become the focus of development and competition in the past 10 years, with the progress of science and technology, many medicines have been developed continuously for the benefit of mankind, the synthesis of these medicines depends on the production of new, high quality pharmaceutical intermediates, so the new drugs are protected by patents, while the intermediates with them do not have problems, so the new pharmaceutical intermediates at home and abroad The market development space and application prospect are very promising.

Pictures

At present, the research direction of drug intermediates is mainly reflected in the synthesis of heterocyclic compounds, fluorine-containing compounds, chiral compounds, biological compounds, etc. There is still a certain gap between the development of pharmaceutical intermediates and the requirements of pharmaceutical industry in China. Some products with high technical level requirements cannot be organized for production in China and basically rely on import, such as anhydrous piperazine, propionic acid, etc. Although some products can meet the requirements of the domestic pharmaceutical industry in terms of quantity, but the higher cost and quality are not up to standard, which affect the competitiveness of pharmaceutical products and need to improve the production process, such as TMB, p-aminophenol, D-PHPG, etc.

It is expected that in the next few years, the world's new drug research will focus on the following 10 categories of drugs: brain function improvement drugs, anti-rheumatoid arthritis drugs, anti-AIDS drugs, anti-hepatitis and other viral drugs, lipid-lowering drugs, anti-thrombotic drugs, anti-tumor drugs, platelet-activating factor antagonists, glycoside cardiac stimulants, antidepressants, anti-psychotic and anti-anxiety drugs, etc.. For these drugs to develop their intermediates is the direction of future development of pharmaceutical intermediates and an important way to expand new market space.

Post time: Apr-01-2021