Perfection is attained by slow degrees; it requires the hand of time.

The world that had to come, had to go is life, as the memories of several generations, Uncle Dahl left forever, the impression of his naive, the impression of his funny, in light and shadow he will be thin world interpretation of deep feelings, in reality he will be the righteousness of the inflammation melted into laughter, as the People’s Daily said, the art of the golden supporting role of Uncle Dahl, in the patriotic plot is always the protagonist, thank you for the world, and At this moment the world is also due to your departure dark corner, and I still believe that your laugh will still light up many people, illuminate many places, inspire warm more young people how to laugh at life, laugh at the storm.

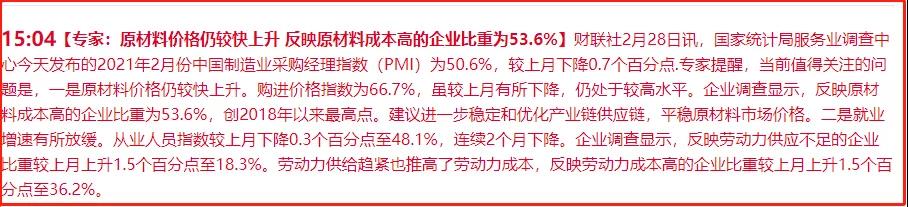

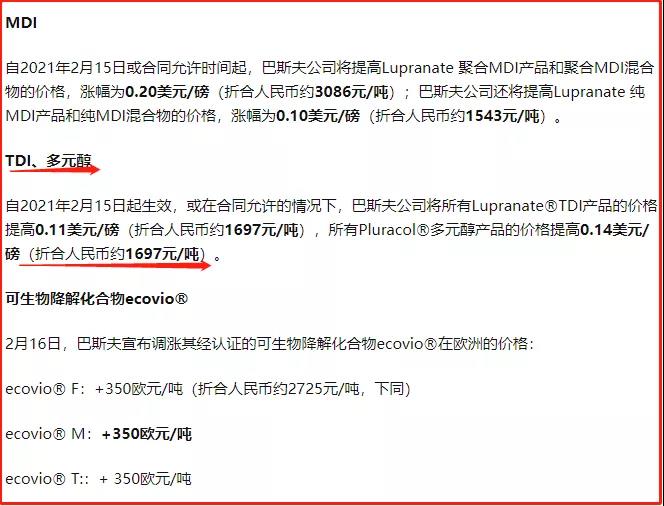

Since this year, especially recently, chemical products ushered in an epic wave of price increases, global chemical giants have cut off production, like the globalization factory boss Germany BASF have entered the rhythm of price increases, first of all, the global new crown epidemic force majeure caused by offshore mines and large farms staff tension, both non-ferrous or chemical products and agricultural productivity are facing a serious decline, such as Newmont Gold mine was temporarily closed last year due to the epidemic, including the Chino copper mine of Freeport in the United States since last year was also closed due to the new crown, etc.

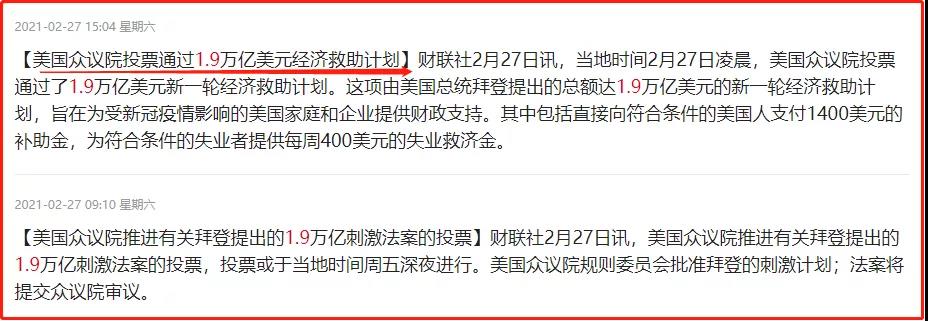

The second important reason for the rising tide is the global central banks’ flood of monetary increases, especially the Federal Reserve’s announcement last year that it would first reduce the federal reserve funds rate to zero and launch a $700 billion QE program, followed by the opening of an unlimited bond purchase mode, that is, every day that week will buy $75 billion of Treasuries and $50 billion of agency home mortgage-backed securities (MBS), while saying that after Yesterday the U.S. House of Representatives passed a $1.9 trillion economic bailout plan on fire, and some of the additional hot money liquidity will inevitably flow into the financial markets, with inflationary expectations of commodity price increases already in play.

Also affected by some extreme weather, like the cold wave in the United States Texas forced the closure of local oil wells and chemical plants, also caused the global chemical giants into a dilemma of production and sales, the supply of raw materials shortage, transport logistics obstruction, another many chemical plants had to cut production costs, while China as the world’s largest commodity importer, the general premium for commodities is not in the hands of China At the same time, China, as the world’s largest importer of commodities, is generally not in the hands of China, and this has caused a passive increase in bulk prices.

You such as the chemical industry majors BASF, a series of chemical product price increases, and the pressure of upstream price increases across the board has been smoothly transmitted to the downstream, which includes a number of industries such as footwear, home appliances, tires, panels, prices and orders are a single negotiation, similar to last year’s mask production and sales, many home appliance companies have orders even scheduled to June, the current factory recruitment is afraid of recruiting people. Some head enterprises even announced that each introduction of a new employee, more to the killer 2600 yuan, is really not afraid of no orders, afraid of no employees.

In fact, the current round of commodity market bull market has long been expected, but did not expect to come to such a tsunami, historically each economic crisis after the commodity market with the economy a reshuffle recovery have gotten a high premium on assets, the real push commodity prices should be a record growth in the money supply, the Federal Reserve in a large number of money printing, far more than the appropriate size, and the Fed’s dovish vocalization and sit The Fed is printing a lot of money, far more than it should, and the Fed’s dovish pronouncements have confirmed the expectation of continued short-term easing, so in the short to medium term, the bull market in commodities has just begun.

This Friday night, industrial chemicals domestic futures quotes have ushered in another jump, can be described as a sound, especially polyol and methanol and soda ash futures contracts, up like a rainbow, have hit a new record high and a new high near the end of the time, the A-share side of the chemical sector is also colorful, but also become the only market adjustment last week to resist the market pressure of the hot sector, the sector currently with the popular leader The Jinniu Chemical Friday intraday quasi-earth day board, but the end of Friday market sentiment is too poor passive open board, as the current chemical body leading, Jinniu Chemical main methanol annual output of 200,000 tons, belonging to a single line of logic, Friday night methanol futures continue to erupt, do not rule out next week the stock period continue to linkage double break new highs, further drive the chemical plate counter-attack trumpet.

Huachang chemical work as the Golden Calf chemical supplement dragon, I expect its trend later will be stronger than the Golden Calf, for three reasons, the first point Huachang chemical company’s main business is not a single, by fertilizer urea, polyol, soda ash three main common composition, which greatly enriched the company’s market risk resistance, multi-product line balance the company’s income and expenditure and business structure, and the company as a whole is dominated by domestic sales, the company’s chemical products The production and sales of the company’s chemical products are ranked in the top of the industry. The second point is that Huachang Chemical is dominated by institutions and lobbyists this round, institutions bought 150 million this week, compared to Jinniu Chemical purely by lobbyists to promote, institutions are more optimistic about the long-term investment returns of Huachang Chemical, so you will find that Thursday negative day actually did not put the volume instead of shrinking, indicating that the funds in this position has locked positions, short-term short term floating chips also borrowed the weakness of the broader market to get a good cleaning, after the market Once the new high, the height is incalculable.

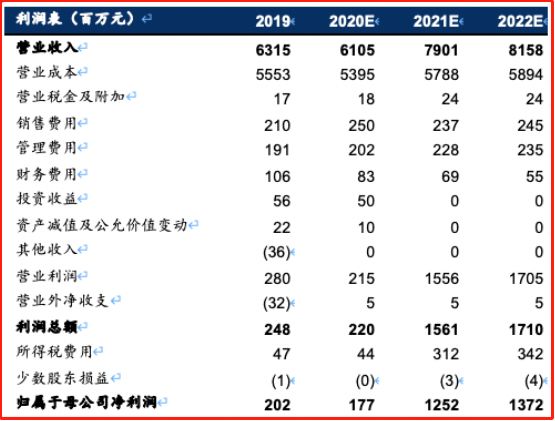

The third important point, performance, performance speaks, the company’s fourth quarter net profit attributable to the mother 150 million, 2021 performance is bound to continue to surge in expectations, especially the performance of the first quarter is expected to carefully study the company’s main product structure, first of all, fertilizer this piece, the national spring cultivation of the country a chessboard, which is also the annual spring agricultural market highlights, especially the release of the agricultural No. 1 document to accelerate the modernization of agriculture The requirements of the agricultural fertilizer and seed breeding are the most important part, with good seeds, no good fertilizer, then good seedlings are blind, China as a traditional grain country, stable production and income is the most basic requirements, so the chemical urea recently is also tight supply pattern. Another is the new energy construction of the 14th Five-Year Plan, which is equivalent to a disguised increase in demand for the production of photovoltaic glass, photovoltaic glass and further boost the demand for soda ash, the company has 660,000 tons / year hydrazine soda ash, soda ash industry boom to improve the company’s revenue profits are positive boost. Finally the recent butyl alcohol price surge, the company is the most flexible beneficiary of the subject, the company also replied in the telephone research, butyl alcohol price per 1,000 yuan, the company’s profits thickened 185 million, the three main business combined with the current market chemical industry boom, this year’s attributable profit will also reach more than 1.2 billion, so it can be inferred that this year’s annual performance compared to last year at least 5-6 times the Space, then said the stock price is currently less than double, the valuation can be said to be seriously undervalued.

Overall, next week the market will also usher in a short rest period, if the chemical non-ferrous sector are unable to lead the market again to stabilize at 3500 a line, then the market will not have a better desire to attack, and once the chemical non-ferrous counter-attack opera opened, the market will resonate rebound upward to fill the gap above the jump, to start a round of quality predictable technical rebound. News on the rumor of stamp duty written into the regulations, some of the tax items are expected to be reduced, although the specific details are unknown, but at least there is the expectation of lower stamp duty, and the Hong Kong side of the stamp duty to raise the real to August before the implementation, so next week’s market sentiment personal see at least the first half of the week will usher in a rebound, focusing on the direction of chemical non-ferrous superimposed on the performance of the popular bulk raw material producers with explosive growth beyond expectations.

The market has risen and fallen, keep a good mind, the market is losing money this week, I also prompted the market risk in the article, in the face of uncertainty in the periphery of the European and American markets may further release risk, the position should also be appropriate to control a little, anxious to eat hot bean curd, see the market to see the market is the first step can not be ignored, with an expectation in mind, and then according to the changes in the market flexible adjustment of trading a strategy. This is the quality that every mature trader should have, losing money is not terrible, the terrible thing is to lose no mentality, the year of the bull has just begun, the long flow of water, the party can travel steadily to far, well, today’s chatter here, wish you a long rainbow account next week!

Read the market, understand the market, comply with the market, and beat the market!

Post time: Mar-04-2021