【 Introduction 】 : As a bulk trading commodity, the trend of the domestic market of sulfur is closely related to the international market. Xiaobian will take you to understand the international market situation of sulfur through the analysis of the international market prices of sulfur, sulfuric acid and phosphate fertilizer.

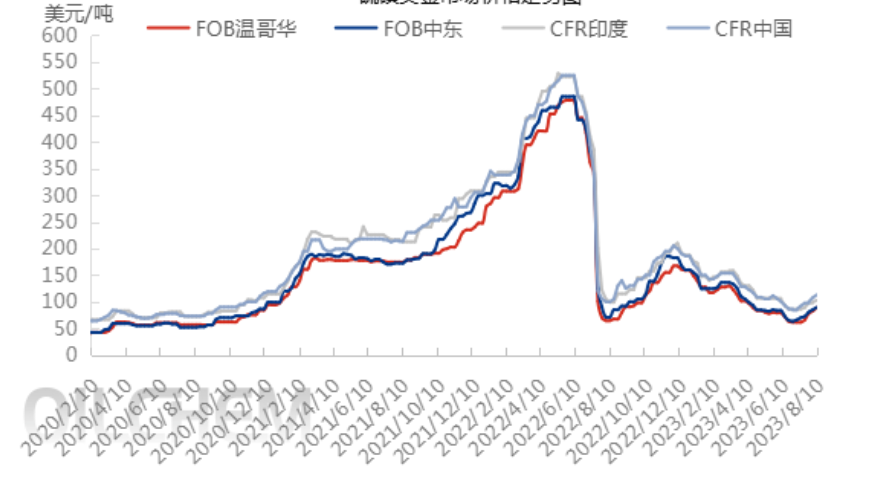

1. The international dollar price fluctuates upward

In 2023, the US dollar market rose slightly, first driven by the RMB market, the Chinese fertilizer autumn procurement market was launched in June, followed by the international fertilizer market in July, and the contract price of Qatar and Kuwait in August was increased by 19/18 US dollars/ton to 82/80 US dollars/ton, and the Indonesian metal demand gradually increased. As of August 10, the import side: FOB Vancouver US $89 / ton, FOB Middle East US $89.5 / ton, up 27.5/26 US $/ ton from July respectively, the export side: CFR India $102.5 / ton, CFR China $113 / ton, up 16.5/113 / ton from July. The strong price of US dollar in sulfur international gives greater support to the RMB market.

2, China’s export of sulfuric acid to Indonesia increased by 229.6%

As the direct downstream of sulfur, sulfuric acid international market synchronous sulfur from negative to positive, sulfuric acid imports in the first half of this year was 175,300 tons, an increase of 16.79% over the same period last year, the main source for Japan and South Korea and Taiwan Province, of which 96.6% of sulfuric acid imports by Shandong, Jiangsu received, the main supply downstream large fine chemical enterprises, etc. In addition, most of the liquid sulfur in Shandong/Jiangsu is mainly long, so the market demand is relatively concentrated. In terms of exports, China’s sulfuric acid exports in the first half of the year were 1,031,300 tons, a decrease of 55.83% over the same period last year, mainly sent to Indonesia, Saudi Arabia, Chile and India, of which because of the demand for metal projects in Indonesia, the export growth rate reached 229.6% over last year.

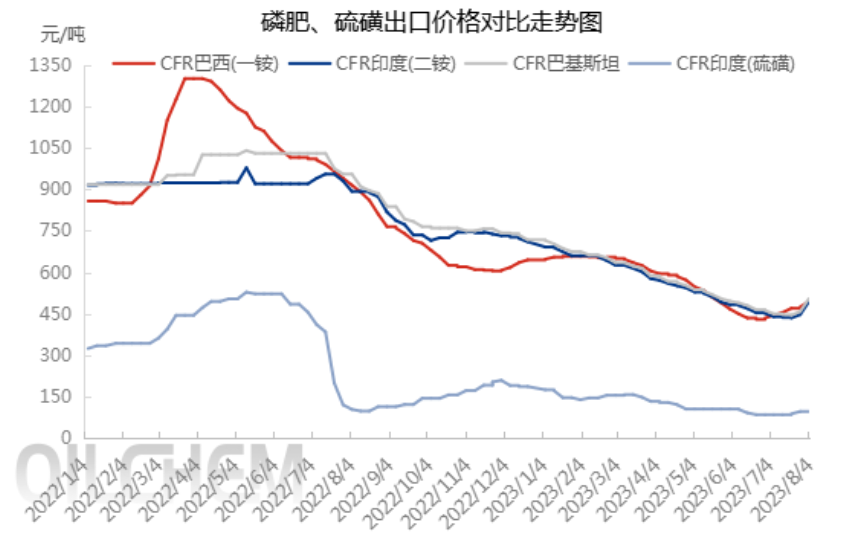

3, the increase in the purchase of international phosphate fertilizer drives up the price of raw materials

In terms of downstream phosphate fertilizer, as the largest importer of phosphate fertilizer in the world, India imported a total of 1.04 million tons in June, an increase of 283.76%, coupled with the impact of greater rainfall in Southeast Asia this year, the demand for fertilizer has made Thailand, Bangladesh and Vietnam and other countries have to increase the purchase of international phosphate fertilizer, and the international market has started to make phosphate prices rise rapidly. At present, the international DAP premium is mostly in CFR530-550 US dollars/ton, and the high price of phosphate fertilizer drives the price of raw sulfur, and the international sulfur market is on the trend. However, at present, the international urea market has been gradually reduced, and the demand for fertilizer market will be in a volatile trend.

4, the international market strong drive to when?

Since June, due to the influence of many factors, international sulfur prices along the way, including the downstream sulfuric acid market and the increase in international phosphate fertilizer demand, jointly contributed to the unification of this round of price increases, in the short term, demand support, sulfur market smooth, the price probability of maintaining an upward trend; In the long run, the heat of the downstream phosphate fertilizer market in the autumn fertilizer period will gradually weaken in September, and the demand for high-priced raw materials and products will be in a relatively stalemate, but the start of domestic winter storage may be noteworthy. It is expected that the sulfur international market will be consolidated and shaken in the later stage.

|

|

| Xuzhou, Jiangsu, China | |

| Phone/WhatsApp : + 86 19961957599 | |

|

Email : Kelley@mit-ivy.com http://www.mit-ivy.com

|

Post time: Aug-16-2023