2023, the fact that polypropylene has been down in May, and has been in the market for the most difficult decision intersection in July. On the macro side, whether overseas interest rates or domestic policy ends are shown on the horizon; But demand and poor domestic demand and exports are weak. Because the market headway has led to the present price high and the weak downstream form of the confrontation, as the production capacity keeps climbing polypropylene, the current industrial chain contradiction has not yet been solved, in the current fierce competition background, the market has entered the most difficult crossroads in history…

The price of polypropylene and yield interaction change

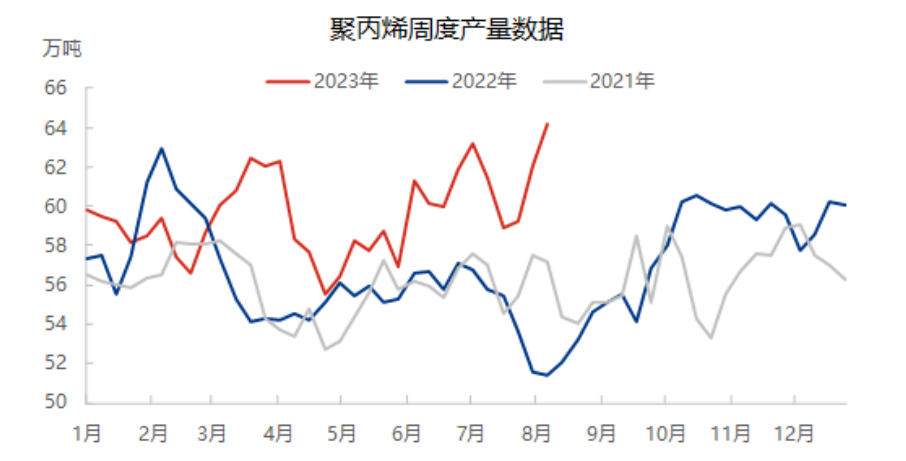

Market influencing factors are complex and changeable, and domestic production is the most important influence on the supply side. According to the data trend in the figure, it can be found that the production data of this year is abnormal, especially the sharp rise and fall of market production in March-April 2023 and the formation of a completely different trend in 2022. The main reason is that this year’s strong expectations led to a sharp rise in market supply significantly concentrated in March, while four new sets of devices totalling 1.85 million tons of PP devices were added from February to March, resulting in a significant increase in the market supply side. The weak reality impact makes the spot market transaction the most worrying problem. The sharp decline in production in April also reflects the efforts made by the market to deal with the weak demand supply side, and the significant increase in the number of maintenance companies has alleviated some of the pressure on the supply side of the market, but it still cannot block the downward trend of continuous breaking in May. Due to the continuous fermentation of the overseas Silicon Valley bank event, the market has increased concerns about the global economy, and the futures board has continuously broken 7000 points in the downward trend, which has caught practitioners unprepared. From July to August, thanks to the continuous strength of the policy end, while boosted by the high amount of maintenance losses, the market was able to ease the downward trend. As of August 10, according to Longzhong data statistics, domestic PP production rose 3.42% year-on-year, up 24.81% quarter-on-quarter.

Maintenance of good boost market key moment to ease market pressure

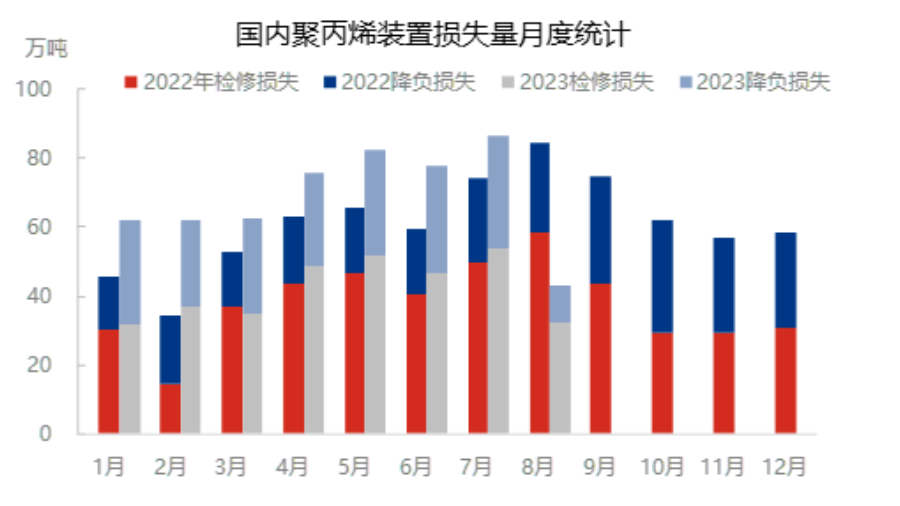

In the face of new expansion of the industrial chain, the loss of the device is a great boost to the relief of the market pressure. Especially in May and July, the loss of the pp device reached a new high, especially in July, with a loss of 48.81 million tons, an increase of 11.16 percent from a year earlier, so that the market in July was driven by the rise of domestic device loss. In fact, the market in July was more likely to be driven by policy funding markets.

Under the grim economic situation in 2023, the overseas inflation situation has not reduced, so that domestic manufacturing orders have not changed, and domestic demand is affected by the decline in the consumer consumption index. Domestic plastics manufacturing industry is also facing great difficulties and challenges, from the domestic polypropylene downstream average operating rate can be found, as of August 10 domestic downstream average operating rate 46%, down 8.48% year-on-year, downstream this year downstream construction is significantly lower than in previous years, which also leads to the main reason for the low average PP price this year.

Polypropylene market into the crossroads of demand into the future key factors

The competitive pattern of the polypropylene market industry chain is constantly upgrading, and both the production end and the downstream product end are facing unprecedented competitive pressure. Due to the market in July and August against the trend, the use of policy and financial power to pull up the weak market, the market will be under greater pressure in the future. After the expected valuation was raised, the change in demand side in September became a key factor to verify the market. At present, the market is at a key crossroads stage, and practitioners are the most confused stage for the market, starting from the current market driving force, the policy side is good for the market, the demand side inhibits the market, and the supply side is not obvious, it is expected that the short-term market repair valuation level is deadlocked, and there is upward space in September, but the upward space will be compressed.

Joyce

MIT-IVY INDUSTRY Co.,Ltd.

Xuzhou, Jiangsu, China

Phone/WhatsApp : + 86 19961957599

Email : Kelley@mit-ivy.com http://www.mit-ivy.com

Post time: Aug-15-2023